By Laura Sneddon is Head of Sales and Distribution at Hinckley & Rugby for Intermediaries

I like to think that what keeps my role engaging is the fact every case brings something different. But for brokers, that variety often brings an element of frustration, especially in Scotland.

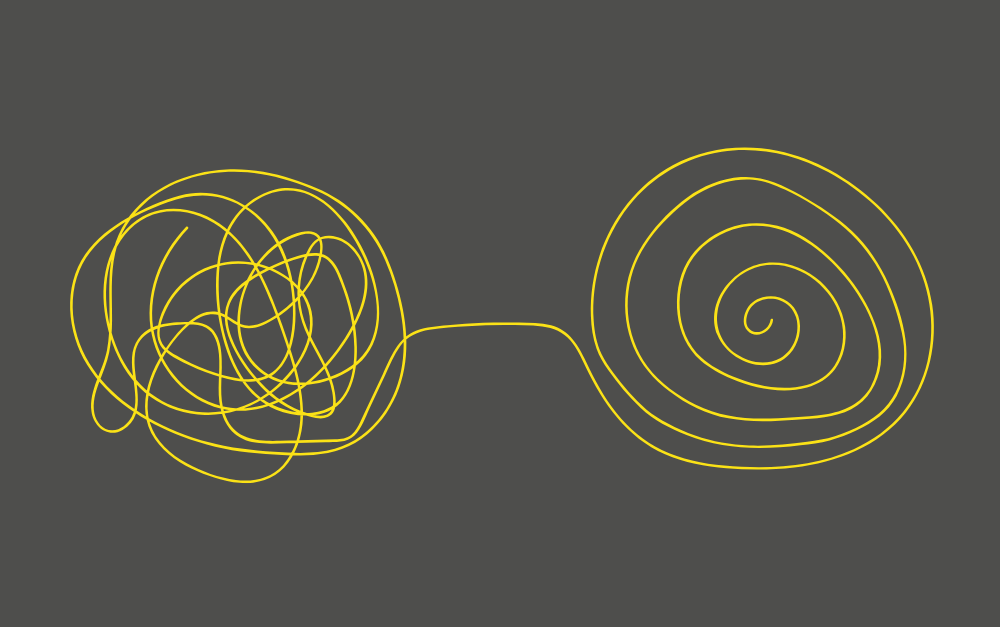

The number of times I hear, “It’s a strong case, but it doesn’t meet every criteria,” says it all. And nine times out of ten, they’re not actually wrong. The client can clearly afford the mortgage, and they’ve got a solid story behind them, but because their income doesn’t look how a computer wants it to, the case fails to get out of the starting blocks.

We’ve had a steady stream of conversations with brokers north of the border, who tell us a similar thing. Clients are being turned away not because they’re risky but because the criteria is too rigid.

One broker in Fife recently told me about a healthcare worker on a Skilled Worker visa. Good income, reliable employer, the lot. But the postcode, the visa and the fact she was paid partly through an agency meant she was knocked back twice. It didn’t need to be that hard. We took the case, assessed it properly, and she moved in six weeks later.

Opening things up

That’s one of the reasons we’ve now made our full residential mortgage range available to the whole of market in Scotland. This includes Income Flex, Credit Flex, Core and our Skilled Worker visa criteria. We haven’t adjusted the criteria to make it fit Scotland and nothing has been watered down. It’s the exact same proposition we offer in England and Wales, and that’s the point. Everyone should have access to a lender who looks at the full picture, not just the postcode.

In May to July 2025, there were 4.43 million self-employed people across the UK, according to the latest figures from the Office for National Statistics1. That’s an increase of more than 130,000 year on year. It’s not a blip. It’s a trend.

So, it’s becoming clear that fixed income is no longer the norm. Many of the clients we’re seeing are self-employed, juggling multiple income sources or working contracts that can vary month to month. That might sound complex, but it’s also reality. And with the economic pressure of the last few years, more borrowers are picking up second jobs or relying on net profit rather than salary. We’ve structured our Income Flex range with that in mind. Whether it’s one year’s accounts or a mixture of income types, we’re open to a proper conversation.

Visa doesn’t mean veto

The same goes for Skilled Worker visa clients. We’re not asking for minimum time remaining on a visa, minimum income, or years of UK residency. If the case makes sense, we’ll look at it. We’re seeing a growing number of clients in Scotland coming through on this route, particularly in the NHS and education sectors. These are people who are fully embedded in their communities and more than capable of maintaining a mortgage.

This isn’t about headlines or coverage. We started by launching into Scotland with PMS and Sesame earlier this year. That limited launch gave us time to listen. The feedback was loud and clear. Brokers wanted full access. They wanted us to keep the same criteria. They didn’t want another name on a panel, they wanted an actual option for those tricky but do-able cases. So we opened things up, and we’re already seeing those cases land.

What it means for brokers

You won’t see big banner campaigns or fancy dashboards from us. What you will get is someone on the phone who knows what they’re doing. A proper look at the case. An honest answer, even if it’s a no. And support that doesn’t disappear once the DIP is in.

We’re here for the real cases. The ones that need a bit of explanation, or a call to clarify something, or a workaround that stays within policy but actually gets the job done. And we’re pleased to now be offering that same support across Scotland.

If you’re working on a case that doesn’t quite fit the usual mould, whether it involves self-employment, visa status or something more nuanced, we’re happy to take a proper look. Some of these cases aren’t complex at all. They just need a lender willing to listen.

This article originally featured in The Intermediary.

Stay informed

Want to be alerted when we launch, update, and withdraw our products?

If you would like to keep up to date with our product launches, criteria updates, and any other changes we make to our product range, you can sign up to our email newsletter below and receive this information straight to your inbox.

Speak to us

Our dedicated Business Development team will be happy to speak to you about any cases you have, explain how our specialist products and flexible criteria can benefit your clients, or answer any questions you have. Get in touch on 01455 894 084. Or send us a message on our Live Chat, our response time is often only seconds!

Notes