By Laura Sneddon is Head of Sales and Distribution at Hinckley & Rugby for Intermediaries

As the UK moves further into 2026, the economic mood still feels somewhat cautious rather than overly confident, particularly perhaps if you’re an individual working on a contract basis.

Business confidence fell sharply at the end of last year, slipping into negative double-digit territory for the first time in three years, according to the ICAEW1.

Employers are reacting to higher costs, tax pressure and weaker sales by slowing recruitment and limiting spend, which tends to affect flexible workers first, even in sectors where demand for skills remains strong.

Contractors key to economic growth

Contractors play a central role across the UK economy, but their working lives rarely fit neatly into traditional employment boxes.

Many are hired on fixed- or short-term contracts to cover gaps, deliver projects, or bring in specialist skills at short notice. Pay is often based on a daily or hourly rate, which can look healthy when annualised, but income rarely arrives evenly. Contracts can end with little warning, payment dates can vary, and gaps between roles are a normal part of working life rather than a sign of instability.

Healthcare provides a clear example. Locum nurses and other clinical staff often move between trusts, working blocks of shifts that change month by month depending on demand.

Construction shows similar patterns, with subcontractors moving between sites and being paid at stages of work rather than on a fixed monthly cycle. In IT, contractors may earn strong rates during a long engagement, only to face a pause while the next role is secured. Over the course of a year, income can be solid, but the monthly picture is rarely smooth.

Mainstream lenders struggle

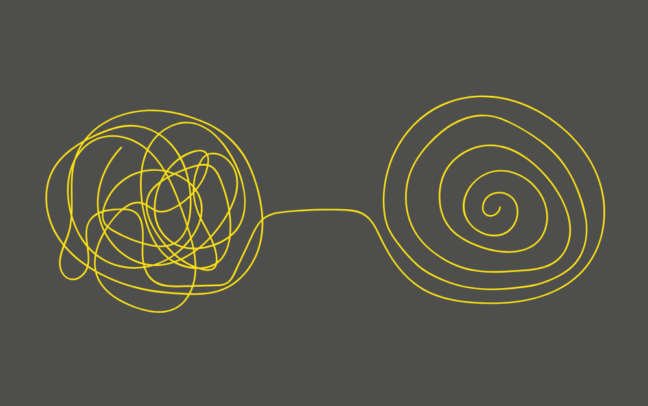

These realities are where many mortgage applications begin to falter. Mainstream lenders are still largely built around permanent employment and predictable payslips, using systems that favour long income histories and simple averages. Short contracts are often seen as a risk, while umbrella company structures and agency arrangements can raise further questions.

For self-employed contractors, the focus on SA302 averages can obscure current earning power, particularly where income has risen or working patterns have changed.

The Construction Industry Scheme highlights this disconnect. Under CIS, contractors deduct tax and NI from pay and pass them directly to HMRC as advance payments towards a subcontractor’s bill2. For those taxed at source, income is already verified and deductions are settled, yet some lenders continue to treat it as uncertain or insist on lengthy trading histories that add little insight on affordability.

Underwriting acumen opens the door

A more practical approach starts by looking at how contractors are actually paid. Income Flex, our mortgage product tailored to individuals with complex incomes, is designed to reflect that reality rather than force applicants into rigid categories.

CIS contractors who are taxed at source are treated in the same way as PAYE, with assessment based on just three months’ payslips. Day-rate contractors are assessed by taking the contract rate and multiplying it by 48 weeks, without applying a minimum income requirement.

Equally, any income paid through agencies or umbrella companies is accepted up to 80% LTV, recognising how common these structures are in sectors such as healthcare and IT.

This can make a meaningful difference for brokers and their clients. One of our recent cases involved a locum nurse working through an umbrella company with six months’ history.

She had steady work and regular shifts but moved between contracts depending on hospital needs. Several lenders declined the application, citing short contract lengths and the income structure. Using Income Flex, her income was accepted without the need for SA302 averages, allowing the broker to place the case efficiently and with far less friction for the client.

In an uncertain economic climate, flexible workers often feel tightening employer budgets first, even as long-term demand remains driven by factors such as an ageing population, ongoing NHS staffing pressures, and continued reliance on specialist skills in technology and care.

For brokers, the challenge is not a lack of contractor clients, but knowing where to place them. This workforce is expanding, not shrinking, and their income patterns are unlikely to become more regular.

Lenders with the knowledge, underwriting expertise and willingness to engage with real-world pay structures should be a broker’s first port of call when supporting these workers, whether the hoped for economic turnaround materialises or not.

You can learn more about our Income Flex range by clicking below or get in touch with a member of our team.

This article originally featured in The Intermediary.

Stay informed

Want to be alerted when we launch, update, and withdraw our products?

If you would like to keep up to date with our product launches, criteria updates, and any other changes we make to our product range, you can sign up to our email newsletter below and receive this information straight to your inbox.

Speak to us

Our dedicated Business Development team will be happy to speak to you about any cases you have, explain how our specialist products and flexible criteria can benefit your clients, or answer any questions you have. Get in touch on 01455 894 084. Or send us a message on our Live Chat, our response time is often only seconds!

Notes