By Laura Sneddon, Head of Mortgage Sales & Distribution

Ongoing economic uncertainty means existing borrowers now face a dilemma as their fixed-rate mortgage deals near the end of their term.

Do they remortgage to a new longer-term fixed-rate deal, giving them the security that monthly repayments won’t rise over the next few years, or opt for a shorter fix or the option of a tracker in order to take advantage of possible rate reductions later this year?

The Bank of England started to reduce interest rates last year, with rates edging down by 25 basis points in February. But to date, these cuts have been slower and shallower than previously forecast, amid sluggish growth in the UK, an upturn in inflation, and the prospect of global trade wars and geopolitical instability.

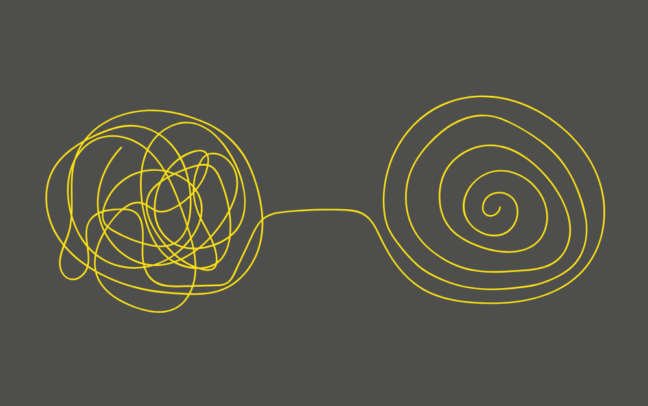

This more volatile background makes it extremely difficult to predict the likelihood of future cuts, reflected in fixed-rate pricing. For borrowers, these difficult decisions have to be made against a backdrop of higher mortgage costs, with both variable and fixed-rate deals now significantly more expensive than five years ago. With many homeowners feeling the pinch, they will be nervous about making a wrong decision that could cost them in the long run.

Given these uncertainties, it’s important for clients to be offered lending solutions that balance security and flexibility in a single product, allowing homeowners to hedge their bets in a complex and uncertain market.

That’s the solution Hinckley & Rugby for Intermediaries can offer.

Flexible options

Traditionally, fixed-rate mortgages have been the go-to choice for those remortgaging, offering protection from unexpected rate rises. However, with the prospect of future rate cuts on the horizon, there may be hesitancy among borrowers to lock into longer-term deals, particularly as most come with hefty ERCs.

This has created a pressing need for more flexible remortgage solutions that can provide certainty around repayments in the near term, without locking people into multi-year contracts with restrictive terms.

No-ERC mortgages: the best of both worlds

To meet this need, we now offer a range of ERC-free variable rate mortgages, providing a middle ground for homeowners who are unsure of their next move.

These deals enable borrowers to remortgage away from higher SVRs whilst retaining the freedom to switch to a cheaper deal if circumstances change, without being penalised by hefty penalties.

For brokers, positioning no-ERC remortgages as a hybrid solution can be a gamechanger. By presenting these mortgages as a strategic financial tool, brokers can empower clients to make confident decisions without feeling trapped by market uncertainty, enabling them to progress with the remortgage process.

Digital innovation

Increased product flexibility and ERC-free mortgages aren’t the only innovations in the remortgage market. New technology, such as the digital portal powered by PEXA, is streamlining the remortgage process, ensuring cases progress smoothly.

Better connectivity between lenders reduces administration for brokers, offers borrowers real-time updates on their cases, and speeds up transaction times across the industry, delivering a more efficient and cost-effective service.

Hinckley & Rugby for Intermediaries has been leading the way when it comes to these new efficiencies. We adopted PEXA’s technology, delivered by Optima Legal, at the end of last year and now offer this to brokers across the market.

The mortgage market continues to evolve, both in response to underlying economic conditions and to embrace the benefits of new technology. As a mutual society, we aim to provide affordable borrowing solutions to homeowners, including those whose needs are not always met by mainstream lenders.

By having access to a flexible product range that adapts to market changes and utilises the latest digital technology, brokers and their clients can make informed choices in an unpredictable climate.

Stay informed

Want to be alerted when we launch, update, and withdraw our products?

If you would like to keep up to date with our product launches, criteria updates, and any other changes we make to our product range, you can sign up to our email newsletter below and receive this information straight to your inbox.

Speak to us

Our dedicated Business Development team will be happy to speak to you about any cases you have, explain how our specialist products and flexible criteria can benefit your clients, or answer any questions you may have. Get in touch on 01455 894 084. Or send us a message on our Live Chat, our response time is often only seconds!