Generally speaking, mortgage lenders prefer borrowers to have a steady level of income. They see it as riskier to lend to the self-employed because of the reliability of that income. On the face of it, that’s understandable.

But in a way, that stance presupposes that the individual’s income is unreliably below the level at which the desired mortgage is deemed affordable. Many lenders will take no account of impressive performance and income until its constancy has been proved from two or more years’ accounts (or SA302s). Only then is the supposition removed, making the individual acceptable to those lenders.

But what if the applicant doesn’t have that proof…yet?

Many lenders use algorithms and automated assessments when considering mortgage applications, and have no flexibility when it comes to that proof. A manual underwriter like Hinckley & Rugby takes a more pragmatic approach.

We understand that self-employed is not a synonym for ‘man with van’. More than four million people in the UK are self-employed, equivalent to around 12% of the country’s workforce. A self-employed person might be a sole trader, contractor, director or partner of a limited company, freelancer (anything from a writer to a mining engineer), consultant, professional sportsperson, or any of a myriad other professions.

We choose to lend on merit. We don’t judge an individual’s choice to be in charge of their own life, or hold that against them. We just need them to show that they can afford the repayments, and assess their reliability based on common sense.

Where most other lenders require two years’ accounts (or SA302s), Hinckley & Rugby only requires one year. And with deserving cases where there is no first-year reporting, we can even consider an accountant’s projections and base our lending decision on that.

And our flexibility doesn’t end with ‘traditional’ self-employment. Subject to our criteria, we can consider all of the following:

- Agency workers

- Bank and locum workers

- Bonus, commission and overtime

- CIS, day-rate, fixed-term, short-term and zero-hours contractors

- Salary + net profit (limited company)

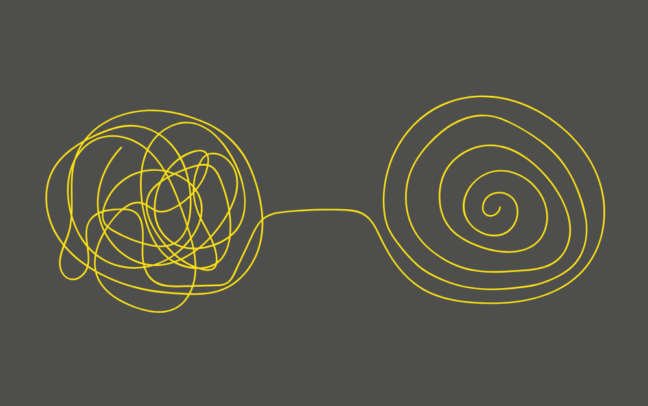

In short, Hinckley & Rugby is different because we are flexible. Most lenders want the applicant’s circumstances to fit one of their mortgages, but we listen and do everything we can to make one of our mortgages fit the applicant’s circumstances.

We understand that there is no one-size-fits-all solution when it comes to the self-employed, which is why we have a toolkit of options to meet most challenges, no matter how complex they may be. In a nutshell, we have the flexibility and the will to get to that hard-to-find ‘yes’ if we can.

Stay informed

Want to be alerted when we launch, update, and withdraw our products?

If you would like to keep up to date with our product launches, criteria updates, and any other changes we make to our product range, you can sign up to our email newsletter below and receive this information straight to your inbox.

Speak to us

Our dedicated Business Development team will be happy to speak to you about any cases you have, explain how our specialist products and flexible criteria can benefit your clients, or answer any questions you may have. Get in touch on 01455 894 084. Or send us a message on our Live Chat, our response time is often only seconds!